European Parcels Market Insight Report 2021

Summary

The European parcels market exceeded €80bn in 2020, having grown briskly in recent years as economic performance across the continent has improved and growth of home shopping has continued. All of the leading countries have seen grown at over 5% CAGR.

Total internet retail sales in Europe reached €525bn in 2020, having grown at 17.6% per year since 2015 with double-digit growth across Europe. Growth from 2019 was €100m.

– The highest level of internet retail is in the UK, where average spend per head was approximately €2,600 in 2020.

– France and Germany are also large markets: combined they are similar in size to the UK and the three countries represent two thirds of the European total.

However, 2020 was a year of major disruption, with economic growth severely impacted across Europe while online retail has increased significantly, especially during lockdown periods.

The impact on the parcels market has not been straightforward.

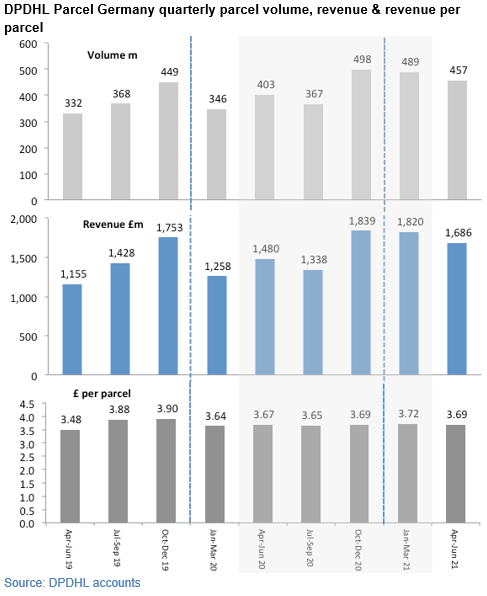

– As the chart with data from DP-DHL Parcel Germany shows, carrier performance has varied significantly from quarter to quarter.

– Carriers with high levels of exposure to the B2B segment have seen their revenues fall while those with extensive B2C presence – in particular postal operators – have seen big increases.

We believe that the net impact is that the market across Europe has grown at a faster rate than would have otherwise have been the case. However the picture varies from country to country, with some seeing a big jump in market size in 2020 and others seeing a far more gradual progression.

Market trends

The parcels market is an area of ongoing development and innovation.

Relevant retail industry trends affecting the market include the increasingly active role played by consumer brands in selling direct and the growth of the subscription box model.

Carriers are investing in improving their information systems, both to provide better information on delivery to end customers and to improve their operational effectiveness. The last mile is a particular focus for process and technology innovations.

– With increased volume of deliveries putting pressure on last mile operations, Out of Home delivery is a more pressing priority and carriers continue to increase their use of lockers and parcel shops

– In the last year, many carriers have deployed cargo bikes, often using smaller or even mobile depots as a base.

– Adoption of electric vans is accelerating. While they reduce emissions in urban areas they still lead to brake and tyre pollution and cause congestion.

Leading online retailers, led by large marketplaces such as Amazon, Zalando, Zara and Argos, are increasingly getting involved in delivery, reflecting the strategic importance of it to their business models. Their large volumes give them significant market power and volumes to support their own operations.

Investment in upgrading operations and incorporating new technology continues to increase.

Several carriers have announced new hubs, generally with higher capacity than existing facilities.

New technologies being deployed include robots for sortation – which have so far been more widely used in Asia and North America than in Europe.

The traditional hub and spoke model remains very important, but some carriers and new entrants to the market are exploring both variations on, and alternatives to, it.

Same day deliveries are an area of innovation and investment. A series of on-demand providers such as Glovo, Paack and Stuart offering immediate delivery for a premium, and routed services, such as Poste Italiane via its Milkman acquisition, providing scheduled delivery. However, volumes remain very small relative to those of mainstream carriers and several high profile operators have withdrawn from the market.

Postal operators are becoming more focused on parcels as their mail volumes fall. As they do so, they are becoming more commercial and more international and their services are changing in frequency and timing.

Third party brokers continue to grow in serving the C2X segment, in particular in European markets, where there are often several alternative carriers.

B2B parcel volumes are growing at slower rates than GDP in most markets as a result of several widespread such as improved equipment reliability and flatter supply chains.

The market leaders are the national postal operators of Germany, France and the UK including their respective parcels networks: DHL, DPD and GLS, and the integrators, with FedEx overtaking UPS following the addition of TNT’s operations. These five now account for around two thirds of the market and all are present in each of the top eight markets we profile in depth in this report.

However, there are still some significant independent groups such as Hermes – which is the largest – and the members of the road transport network alliances such as Eurodis and Net Express.

The large groups have continued to grow via add-on acquisitions in recent years.

The main organic change in share has come from Amazon, which has continued to increase the scope of its delivery operations with local delivery capabilities established in the UK, Italy, Germany, France, Spain and Austria.

– It now openly offers its services as an end-to-end carrier to third party shippers, focusing on medium sized B2C shipper with 20+ parcels per day

– It is building European road and air networks to support its cross-border delivery capability

Outlook

We expect further market growth after 2021, although the rate of growth is likely to vary significantly between countries with the B2B / B2C mix being an important factor.

In those countries where online retail expanded significantly during COVID-19 lockdown, this may have represented a shifting forward of the next few years of growth, meaning there is less growth to come over the rest of the forecast period – hence overall market growth will be slower from 2021-25.

Another key factor is the speed with which economies recover from the pandemic-induced downturn. Initial expectations were for an immediate GDP bounceback, but more recent forecasts suggest only a partial recovery in 2021 and that 2019 GDP levels will not be reached again until 2022 across Europe as a whole with some countries, and not until 2023 in some countries such as Spain the UK.

The main risks to the forecast relate to the two factors mentioned above:

– It is possible that, as the full data on 2021 retail emerges, the re-opening of the high street may have seen much of the growth in online retail seen in 2020 flow back to physical stores, leading to a stagnation or even fall in the B2C segment in 2021.

– GDP recovery could be slower than currently forecast if becomes clear that the pandemic shutdowns have caused lasting economic damage for example with widespread company closures and a spike in unemployment. This would be likely to lead to a slower recovery, potentially along the lines of that seen post-2009.

We also note that there is potential upside to the forecast if the 2020 shift to online retail turns out to have become a tipping point where a large proportion of shoppers change their buying habits permanently away from the high street towards online, and physical retail enters terminal decline, other than in selected niches. The data which will determine whether this is the case or not is starting to emerge but is far from complete.

What does the report cover?

European Parcels: Market Insight Report 2021 sets out the market structure, size, growth, key trends and competitive landscape, covering eight main countries in depth: Germany, UK, France, Spain, Italy, Netherlands, Belgium and Poland. These markets represent approximately 75% of European GDP and, according to our market model, over 80% of total parcels revenues.

The other countries included in our continent-wide overview and market size estimates are Switzerland, Sweden, Norway, Austria, Denmark, Greece, Finland, Portugal, Ireland, Czech Republic, Romania, Hungary, Slovak Republic, Croatia, Bulgaria, Slovenia, Serbia, Lithuania, Latvia, Luxembourg, Estonia, Bosnia and Herzegovina, Iceland, Albania, FYR Macedonia, Malta and Montenegro. Russia and Turkey are excluded.

Our definition of the parcels market includes domestic, intra-European and international parcels. It also includes business-to-business, business-to- consumer and consumer consigned parcels.

– Parcel weight definitions vary, between operators and countries, but most describe parcels up to various weights approaching 40 kg.

– All service levels are included (time definite and deferred).

– Adjacent services, such as mail, pallet distribution, groupage, freight forwarding, same day delivery fulfilment and contract logistics are excluded.

The report provides historical and forecast market sizes covering the period from 2015-2025 .

– Market sizes are presented in value and volume terms.

– Market values are presented on a constant currency basis.

– The market is segmented by country and, within each country and at the overall European level, between B2B, B2C and C2X.

The report includes in-depth profiles of the European operations of the following groups:

– DP DHL

– UPS

– FedEx (including TNT)

– Royal Mail Group

– Le Groupe La Poste / DPD

– Hermes

– Poste Italiane

– Amazon Logistics

The report draws on:

– Apex Insight’s work on the parcels markets in several key countries and regions

– Our consulting work in the industry which has included advising on market and strategic issues and the attractiveness of parcel company acquisitions

Clients purchasing it are entitled to have an expert call with our analysts to discuss its findings and any questions that they may have on it or the market in general.

What are the sources and methodology?

The main sources for the report are

– Extensive desk research on the global parcel delivery market and its operators covering company accounts, websites and other sources

– Published information on key market drivers such as economic data and estimates of online retail levels and practices

– Interviews with senior-level contacts in the market

The key input to our market size estimates is a bottom-up analysis of the revenues of the parcel companies we have identified as operating in each of the main countries covered.

Adjustments have been made to compensate for missing data and to reflect the extent to which these companies are involved in other logistics activities in addition to parcels.

We have used this data as the basis on which to construct our market model.

– The model produces historical and forecast growth estimates covering the period from 2014-2024 which are based on trends in company revenue and drivers such as economic performance and levels and patterns of home shopping.

– The main model inputs and assumptions are discussed in detail in the report.

Who is it useful for?

The report is intended for:

– Owners and operators of parcel networks

– Customers of those networks, in particular, retailers who sell via the internet

– Investors in these businesses

– Market regulators and policymakers

– Banks, analysts, consultants and other parties with interests in the sector